Legal Guardianship for Your Legacy: Estate Planning Lawyer Garden City NY

Wiki Article

Estate Preparation Attorney Offering Personalized Legal Solutions to Protect Your Tradition and Lessen Tax Obligation Implications

Are you searching for a relied on estate preparation lawyer to shield your heritage and minimize tax implications? Look no more. Our tailored lawful remedies are made to safeguard your assets and ensure that your loved ones are dealt with. With our know-how and advice, you can have tranquility of mind recognizing that your dreams will certainly be recognized and your estate will be handled effectively. Let us assist you navigate the complexities of estate planning and safeguard your future.

The Importance of Estate Preparation

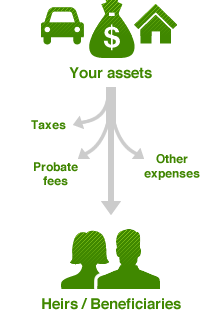

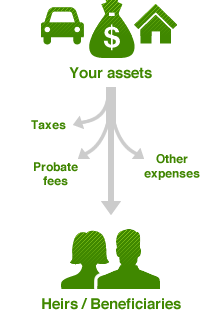

If you wish to secure your properties and make certain a smooth transfer of riches to your enjoyed ones, estate planning is crucial. By creating a comprehensive estate strategy, you can have satisfaction understanding that your wishes will certainly be executed and your liked ones will certainly be taken treatment of after you are gone. Estate preparation entails making crucial choices about how your properties will be distributed, that will handle your affairs if you come to be incapacitated, and also who will certainly care for your small kids if you die. Without an appropriate estate plan in location, your assets might be subject to probate, which can be pricey, lengthy, and might lead to your assets being distributed in a manner that you did not mean. Additionally, without an estate strategy, your loved ones might face unnecessary burdens, such as conflicts over your properties and prospective tax obligation implications. By dealing with a skilled estate preparation attorney, you can make sure that your dreams are complied with, your enjoyed ones are offered, and your possessions are protected. Don't wait till it's far too late-- start estate preparation today to safeguard your tradition and decrease any prospective concerns that may emerge in the future.Comprehending Tax Ramifications in Estate Preparation

To totally shield your properties and make certain a smooth transfer of wide range to your enjoyed ones, it is crucial to understand the tax implications associated with estate planning. Estate preparation entails making vital choices concerning exactly how your possessions will be distributed after your death, yet it additionally incorporates just how taxes will affect those circulations.

One vital tax obligation consideration in estate planning is the inheritance tax. This tax obligation is enforced on the transfer of building upon fatality and can considerably decrease the amount of wide range that is handed down to your beneficiaries. Understanding estate tax obligation legislations and laws can help you minimize the effect of this tax and make the most of the quantity of wide range that your enjoyed ones will certainly obtain.

One more tax effects to take into consideration is the funding gains tax obligation. When specific assets, such as stocks or actual estate, are offered or transferred, resources gains tax might be suitable. By purposefully planning your estate, you can take benefit of tax exceptions and deductions to minimize the funding gains tax problem on your beneficiaries.

In addition, it is essential to recognize the gift tax obligation, which is troubled any kind of gifts you make throughout your life time. Cautious preparation can help you browse the present tax regulations and guarantee that your presents are given up the most tax-efficient means.

Techniques for Guarding Your Legacy

By partnering with a seasoned estate planning attorney, you can properly safeguard your tradition via personalized legal approaches tailored to your particular requirements. These strategies are developed to make sure that your properties are safeguarded and distributed according to your dreams, while minimizing potential conflicts and difficulties from recipients or creditors. One key technique is the production of a comprehensive estate plan that includes a will, count on, and powers of attorney. A will certainly enables you to mark exactly how your assets will certainly be dispersed upon your fatality, while a count on can offer extra defense and control over the circulation of properties. Powers of lawyer allow you to appoint someone you depend make monetary and health care decisions in your place in the event of incapacity. Another important technique is making use of gifting and charitable providing to decrease the size of your estate and minimize estate taxes. By gifting assets to loved ones or philanthropic companies throughout your life time, you can not only reduce your estate's taxable value yet additionally give for your family members and assistance triggers that are necessary to you. Furthermore, establishing a family members minimal collaboration or limited liability company can aid secure your possessions from potential creditors and offer the smooth shift of ownership to future generations. Overall, functioning with a knowledgeable estate planning attorney linked here can give you with the peace of mind knowing that your heritage is shielded and your desires will be accomplished.How an Estate Planning Lawyer Can Help

One crucial way an estate planning lawyer can aid is by offering personalized legal advice to ensure that your possessions are shielded and distributed according to your desires while decreasing potential conflicts and obstacles. Estate planning can be a complicated procedure, and having a lawyer by your side can make all the difference.Primarily, an estate preparation lawyer will listen to your certain objectives and concerns. They will make the effort to recognize your unique situations and tailor a plan that satisfies your demands. This personalized method guarantees that your desires are properly mirrored in your estate strategy.

In addition, an estate preparation lawyer will have a deep understanding of the legal requirements and regulations bordering estate preparation. They will certainly stay up to date with any adjustments in the law that might wikipedia reference influence your strategy - elder lawyer garden city ny. This know-how enables them to make sure and navigate potential challenges that your plan is lawfully audio

Moreover, an estate planning lawyer can assist minimize tax obligation ramifications. They will have expertise of tax obligation laws and approaches to assist you maximize your estate's worth and reduce tax obligation concerns for your beneficiaries.

In the regrettable event of obstacles or conflicts to your estate strategy, an attorney can provide the needed guidance and depiction - elder lawyer garden city ny. They can help solve conflicts and secure your wishes from being overlooked

Personalized Legal Solutions for Your Details Needs

Obtain customized legal remedies to address your certain demands with the help of an estate planning lawyer. Estate planning is a complicated procedure that calls for careful factor to consider of your unique scenarios and objectives. An experienced attorney can give personalized assistance and develop a comprehensive plan that safeguards your tradition and decreases tax implications.

An estate Discover More Here planning attorney will make the effort to listen to your worries, recognize your objectives, and analyze your existing scenario. They will certainly after that create a tailored strategy that addresses your special scenarios. This may include creating a will or trust, establishing powers of lawyer, marking recipients, or carrying out methods to lessen inheritance tax.

By working with an estate planning lawyer, you can make sure that your possessions are distributed according to your wishes, your enjoyed ones are offered, and your tax obligation obligation is reduced. They will browse the intricacies of estate legislation in your place and give you with assurance understanding that your legacy is protected.

Do not leave your estate preparing to chance. Seek advice from an estate planning attorney to obtain individualized legal remedies that are customized to your specific demands.

Verdict

In final thought, working with an estate planning attorney is crucial to protecting your heritage and minimizing tax ramifications. Do not wait, speak with an estate preparation lawyer today to secure your future.Are you looking for a trusted estate planning lawyer to shield your legacy and lessen tax obligation effects?One key tax factor to consider in estate preparation is the estate tax obligation. Another essential method is the usage of gifting and philanthropic offering to reduce the size of your estate and reduce estate tax obligations.In addition, an estate preparation lawyer will certainly have a deep understanding of the legal requirements and policies surrounding estate planning.In final thought, employing an estate preparation lawyer is necessary to guarding your heritage and minimizing tax implications.

Report this wiki page